With The Impact of Crypto on Global Financial Systems at the forefront, get ready to dive into a world where digital currencies clash with traditional finance, creating a new wave of opportunities and challenges.

From decentralized finance to regulatory concerns, this topic explores the dynamic landscape of cryptocurrency and its profound effects on the global financial stage.

Overview of Crypto and Global Financial Systems

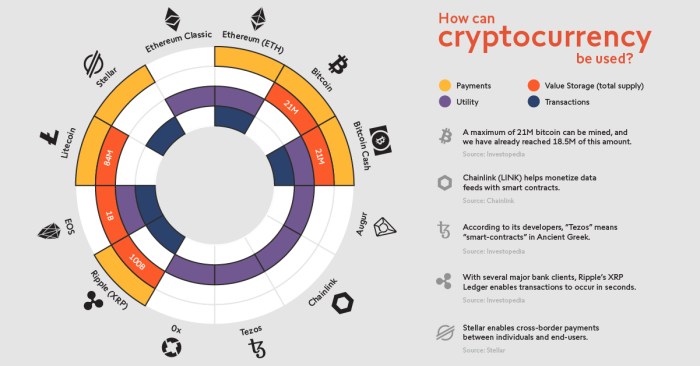

Cryptocurrency has emerged as a digital form of money that operates independently of traditional banking systems. It utilizes cryptography for secure financial transactions and is decentralized, meaning it is not controlled by any central authority like a government or bank. This new form of currency has significantly impacted global financial systems in various ways.

Impact of Decentralized Finance (DeFi)

Decentralized finance, or DeFi, refers to a system where financial services are provided on a decentralized blockchain network. This eliminates the need for intermediaries like banks, allowing users to engage in financial activities such as lending, borrowing, and trading directly with one another. DeFi has revolutionized the way financial services are accessed and has opened up new opportunities for individuals worldwide.

Role of Blockchain Technology

Blockchain technology plays a crucial role in revolutionizing financial transactions by providing a transparent and secure way to record and verify data. Utilizing a decentralized ledger, blockchain ensures that transactions are immutable and cannot be altered once recorded. This technology has the potential to streamline processes, reduce costs, and increase efficiency in various financial sectors, ultimately transforming the way we conduct business and manage finances.

Adoption and Acceptance of Cryptocurrency

Cryptocurrencies have been gaining increasing acceptance from major corporations and financial institutions around the world. Companies like Tesla, Square, and PayPal have started to incorporate cryptocurrencies into their business operations, allowing customers to make purchases using digital assets. This growing acceptance reflects a shift towards recognizing the potential of cryptocurrencies in the global financial landscape.

Growing Acceptance by Major Corporations

- Major corporations, such as Tesla, have invested in Bitcoin as a treasury reserve asset, signaling a vote of confidence in the future of cryptocurrencies.

- Financial institutions like JPMorgan Chase have started offering cryptocurrency services to their clients, further legitimizing the use of digital assets.

- Companies like PayPal have enabled customers to buy, sell, and hold cryptocurrencies on their platform, making it easier for individuals to engage with digital assets.

Challenges Faced by Governments

- Governments are grappling with the task of regulating cryptocurrencies to prevent illicit activities like money laundering and tax evasion, while also ensuring innovation and growth in the sector.

- Integrating cryptocurrencies into existing financial frameworks poses challenges in terms of oversight, security, and stability of the financial system.

- The decentralized nature of cryptocurrencies makes it difficult for governments to control and monitor transactions, raising concerns about financial stability and consumer protection.

Potential Benefits of Adopting Cryptocurrencies

- Businesses can benefit from lower transaction fees, faster cross-border payments, and increased financial inclusion by accepting cryptocurrencies as a form of payment.

- Individuals can enjoy greater financial autonomy, privacy, and security by using cryptocurrencies for peer-to-peer transactions and investments.

- Cryptocurrencies have the potential to reduce reliance on traditional banking systems, providing an alternative financial infrastructure for those underserved by traditional institutions.

Economic Implications of Crypto on Global Financial Markets

Cryptocurrency has had a significant impact on global financial markets, particularly in terms of economic implications. The volatile nature of cryptocurrency prices has created both opportunities and challenges for traditional financial markets.

Volatility of Cryptocurrency Prices and its Effect on Traditional Financial Markets

The volatile nature of cryptocurrency prices has made them attractive to investors seeking high returns in a short period. However, this volatility also poses risks to traditional financial markets. Sudden price fluctuations in cryptocurrencies can lead to panic selling in traditional asset classes like stocks and bonds, causing market instability.

Investment Opportunities in Cryptocurrencies vs. Traditional Assets

Investing in cryptocurrencies offers unique opportunities not found in traditional assets like stocks and bonds. Cryptocurrencies have the potential for rapid growth and high returns, attracting investors looking for alternative investment options. However, the lack of regulation and security concerns in the crypto market make it riskier compared to traditional assets.

Impact of Crypto Trading Platforms on Accessibility to Financial Markets

Crypto trading platforms have revolutionized the way people access financial markets. These platforms have made it easier for individuals to buy, sell, and trade cryptocurrencies, democratizing access to financial markets. This increased accessibility has allowed a wider audience to participate in investment opportunities that were previously reserved for institutional investors.

Security and Regulatory Concerns in the Crypto Space: The Impact Of Crypto On Global Financial Systems

Cryptocurrency transactions and exchanges come with various security risks that can affect both individuals and organizations. The decentralized nature of crypto and the pseudonymous transactions make it challenging to trace and recover lost funds in case of theft or fraud. Hacking incidents on exchanges and wallets are common, leading to significant financial losses for users.

Security Risks in Cryptocurrency Transactions

- Phishing attacks: Hackers create fake websites or emails to trick users into revealing their private keys or login credentials.

- Malware: Malicious software can infect computers or devices to steal cryptocurrency wallets or private keys.

- Double-spending: This occurs when the same cryptocurrency is spent more than once due to a flaw in the blockchain network.

Regulatory Challenges for Governments

- Regulatory clarity: Governments struggle to create comprehensive laws and regulations to govern the use of cryptocurrencies due to their global and decentralized nature.

- Money laundering and terrorism financing: Cryptocurrencies are often used for illicit activities, making it difficult for authorities to track and monitor transactions.

- Tax evasion: The anonymity of transactions in the crypto space poses challenges for tax authorities in enforcing compliance and collecting taxes.

Importance of Cybersecurity Measures, The Impact of Crypto on Global Financial Systems

- Secure wallets: Users should store their cryptocurrency in secure wallets with two-factor authentication and encryption to prevent unauthorized access.

- Regular updates: Keeping software and wallets up to date with the latest security patches can help protect against vulnerabilities and hacks.

- Education and awareness: Promoting cybersecurity best practices among users can help mitigate the risks associated with using cryptocurrencies.