How to Track Your Crypto Investments is your ultimate guide to navigating the complex world of cryptocurrency portfolios. Dive into the strategies and tools needed to manage your investments like a pro.

Learn how to monitor your crypto assets effectively and make informed decisions that can lead to financial success.

Introduction to Crypto Investments Tracking

Investing in cryptocurrencies can be a wild ride, with prices fluctuating like crazy. That’s why it’s crucial to track your crypto investments like a pro. By keeping a close eye on your portfolio, you can make smarter decisions and stay ahead of the game.

The Importance of Tracking Crypto Investments

Tracking your crypto investments is like having a roadmap in a jungle – it helps you navigate the ups and downs of the market. By monitoring your investments regularly, you can spot trends, identify potential risks, and adjust your strategy accordingly.

- Stay on Top of Market Trends: Tracking your investments allows you to see how the market is moving and adjust your portfolio accordingly.

- Manage Risk: By monitoring your investments, you can identify potential risks and take steps to mitigate them before it’s too late.

- Informed Decision Making: When you track your investments, you have all the data you need to make informed decisions about buying, selling, or holding onto your assets.

Methods of Tracking Crypto Investments

When it comes to tracking your crypto investments, there are several methods you can use to stay on top of your portfolio. Whether you prefer a hands-on approach or rely on technology, there are options to suit your needs.

Manual Tracking Methods

If you prefer a more hands-on approach to tracking your crypto investments, manual methods can be effective. This involves keeping detailed records of your transactions, including buy and sell orders, prices, and dates. By manually updating your portfolio, you have full control over the accuracy of your data.

Cryptocurrency Portfolio Tracking Apps

For those who prefer a more automated approach, cryptocurrency portfolio tracking apps are a popular choice. These apps connect to your exchange accounts and wallets, pulling in real-time data to give you a comprehensive view of your investments. They often provide features such as price alerts, portfolio analytics, and performance tracking.

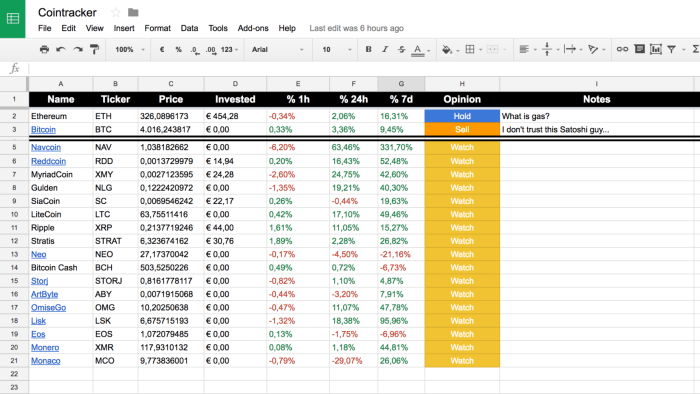

Advantages and Disadvantages of Using Spreadsheet Tools

- Advantages: Spreadsheet tools, such as Excel or Google Sheets, offer flexibility and customization in tracking your crypto investments. You can create personalized formulas, charts, and graphs to analyze your portfolio performance. Additionally, spreadsheet tools are easily accessible and can be used offline.

- Disadvantages: On the downside, spreadsheet tools require manual input of data, which can be time-consuming and prone to human error. They may also lack real-time updates and advanced features found in portfolio tracking apps.

Setting Up Tracking Systems

Setting up a tracking system for your crypto investments is crucial to stay on top of your portfolio’s performance. Here’s how you can set up an effective tracking system:

Creating a Diversified Crypto Portfolio

Building a diversified crypto portfolio involves investing in a variety of cryptocurrencies to spread out risk. Here’s how you can create a diversified crypto portfolio:

- Research different cryptocurrencies to understand their potential and risks.

- Allocate your investments across various crypto assets to minimize risk exposure.

- Consider investing in different types of cryptocurrencies, such as stablecoins, utility tokens, and digital currencies.

- Regularly review and rebalance your portfolio to ensure it remains diversified.

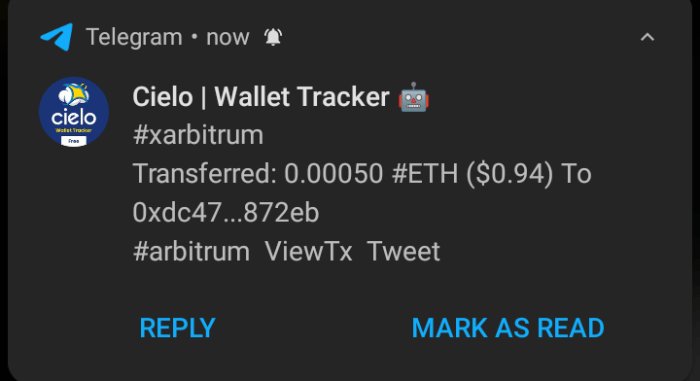

Setting Up Alerts for Price Changes

Setting up alerts for price changes is essential to keep track of your investments in real-time. Here’s how you can set up alerts for price changes:

- Choose a reliable cryptocurrency tracking platform or app that offers price alert features.

- Select the cryptocurrencies you want to monitor and set your desired price thresholds for alerts.

- Customize your alert settings based on the frequency and type of notifications you prefer.

- Stay informed about market movements and act promptly based on the alerts you receive.

Importance of Tracking Multiple Cryptocurrencies in One Place

Tracking multiple cryptocurrencies in one place provides a comprehensive overview of your crypto portfolio’s performance. Here’s why it’s important:

- Streamlines the monitoring process by consolidating all your investments in a single platform.

- Facilitates comparison and analysis of different cryptocurrencies’ performance and price movements.

- Helps you make informed decisions based on the overall performance of your diversified portfolio.

- Enables you to track trends and identify potential opportunities or risks across multiple crypto assets.

Tracking Performance and Returns: How To Track Your Crypto Investments

When it comes to tracking the performance and returns of your crypto investments, there are a few key points to keep in mind.

Calculating ROI for Crypto Investments

Calculating the Return on Investment (ROI) for your crypto investments is crucial to understanding how profitable they have been. The formula for ROI is:

ROI = (Net Profit / Cost of Investment) x 100

This calculation will give you a percentage that represents the return you have received on your initial investment.

Importance of Analyzing Historical Performance Data

Analyzing historical performance data is essential for making informed decisions about your crypto investments. By looking at past performance, you can identify trends, patterns, and potential areas for improvement.

- Reviewing historical data helps you understand how your investments have performed over time.

- It allows you to spot any patterns or trends that may impact future performance.

- By analyzing past data, you can make more informed decisions about your investment strategy moving forward.

Tips on Tracking Profits and Losses Effectively, How to Track Your Crypto Investments

Tracking profits and losses effectively is key to managing your crypto investments successfully. Here are some tips to help you stay on top of your financial performance:

- Keep detailed records of all your transactions, including buy/sell prices, dates, and quantities.

- Use a tracking tool or spreadsheet to monitor your profits and losses in real-time.

- Regularly review your investment portfolio to assess performance and identify areas for improvement.

- Consider setting profit targets and stop-loss orders to help manage risk and maximize returns.

Security Measures for Tracking Crypto Investments

Keeping your crypto investment tracking secure is crucial to protect your financial information and assets. Implementing the best security practices will help safeguard your data from unauthorized access.

Using Two-Factor Authentication for Portfolio Tracking Apps

- Enable two-factor authentication (2FA) on your portfolio tracking apps to add an extra layer of security.

- 2FA requires a second form of verification, such as a code sent to your phone, in addition to your password.

- This helps prevent unauthorized access even if your password is compromised.

Safeguarding Sensitive Financial Data

- Avoid sharing sensitive financial information, such as account credentials or private keys, with anyone.

- Use strong and unique passwords for all your accounts and consider using a password manager to securely store them.

- Regularly update your passwords and enable encryption where possible to protect your data.

- Be cautious of phishing attempts and only access your portfolio tracking apps through secure and verified channels.