Customer Acquisition Cost (CAC) sets the stage for businesses to understand the true cost of acquiring customers. Get ready to dive into the world of CAC, where numbers meet strategy in a high-stakes game of marketing mastery.

From unraveling the complexities of CAC calculations to exploring optimization strategies, this topic will unveil the secrets to enhancing profitability and driving growth.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) refers to the total amount of money a business spends on acquiring a new customer. This includes all marketing and sales expenses incurred to attract and convert a potential customer into a paying customer.CAC is important for businesses as it helps them understand the effectiveness of their marketing and sales strategies. By calculating CAC, businesses can determine how much they need to invest in acquiring new customers compared to the revenue generated from those customers.

This information is crucial for making informed decisions about resource allocation and budgeting.

Examples of Calculating CAC in Different Industries

- In the e-commerce industry, CAC can be calculated by dividing the total marketing and sales expenses by the number of new customers acquired in a specific period.

- In the SaaS (Software as a Service) industry, CAC can be calculated by dividing the total sales and marketing expenses by the number of new customers acquired within a certain timeframe.

- In the retail industry, CAC can be calculated by dividing the total advertising and promotional expenses by the number of new customers gained through those efforts.

Significance of Understanding CAC for Effective Marketing Strategies, Customer Acquisition Cost

Understanding CAC is essential for developing effective marketing strategies because it helps businesses optimize their customer acquisition processes. By knowing how much it costs to acquire a new customer, companies can focus on channels and tactics that yield the highest return on investment. Additionally, understanding CAC enables businesses to set realistic goals, improve customer retention efforts, and ultimately drive growth and profitability.

Factors influencing Customer Acquisition Cost

Customer Acquisition Cost (CAC) is influenced by various factors that businesses need to consider in order to optimize their marketing strategies and budget allocation. Understanding these key factors can help businesses make informed decisions to improve their CAC and overall profitability.

Impact of Different Marketing Channels on CAC

Marketing channels play a significant role in determining CAC, as each channel has its own cost structure and effectiveness in reaching target customers. For example:

- Online advertising through platforms like Google Ads or social media can have variable costs based on competition and targeting options.

- Content marketing and efforts may have lower upfront costs but require consistent investment over time to yield results.

- Traditional channels like TV or print ads may have higher initial costs but can reach a broader audience.

Role of Customer Segmentation in Determining CAC

Customer segmentation involves grouping customers based on similar characteristics or behaviors, which can impact CAC in the following ways:

- Targeting specific customer segments allows businesses to tailor their marketing messages and offers, leading to higher conversion rates and lower CAC.

- Segmentation helps identify high-value customers who are more likely to make repeat purchases, thus reducing overall CAC over time.

Impact of Customer Lifetime Value on CAC Calculations

Customer Lifetime Value (CLV) is the total revenue a business can expect from a customer throughout their entire relationship. Understanding CLV is crucial for optimizing CAC calculations because:

- Higher CLV allows businesses to allocate more resources towards customer acquisition, increasing CAC efficiency.

- By focusing on acquiring customers with high CLV potential, businesses can justify higher acquisition costs knowing the long-term value they bring.

Strategies to optimize Customer Acquisition Cost

Reducing Customer Acquisition Cost (CAC) is crucial for the success of any business. By implementing effective strategies, businesses can maximize their marketing budget and improve overall profitability.

Importance of Conversion Rate Optimization

Conversion Rate Optimization (CRO) plays a key role in lowering CAC. By improving the efficiency of your marketing campaigns and website, you can increase the number of conversions without increasing your advertising spend.

- Optimize landing pages for higher conversion rates.

- Create compelling call-to-action buttons to encourage user interaction.

- Implement A/B testing to identify the most effective marketing strategies.

Payback Period and its Relation to CAC

The Payback Period refers to the time it takes for a business to recoup the cost of acquiring a new customer. By reducing the payback period, businesses can improve their cash flow and profitability.

Payback Period = Cost of Customer Acquisition / Monthly Recurring Revenue

Case Studies of Successful CAC Optimization Strategies

Several companies have successfully optimized their CAC through innovative strategies. By studying these case studies, businesses can learn valuable insights on how to improve their own customer acquisition processes.

- Company A implemented a referral program that incentivized existing customers to refer new clients, resulting in a significant decrease in CAC.

- Company B utilized social media advertising to target specific customer segments, leading to higher conversion rates and lower CAC.

- Company C optimized their email marketing campaigns by personalizing content and offers, resulting in increased customer engagement and reduced CAC.

Calculating and analyzing Customer Acquisition Cost

When it comes to analyzing the Customer Acquisition Cost (CAC), understanding how to calculate it is crucial for businesses to make informed decisions. Let’s break down the steps to calculate CAC and explore its significance in the business landscape.

Step-by-step how to calculate CAC

To calculate CAC, you need to divide the total costs associated with acquiring customers within a specific period by the number of customers acquired during that same period. The formula for calculating CAC is:

CAC = Total Acquisition Costs / Number of Customers Acquired

By knowing this metric, companies can assess the effectiveness of their marketing and sales efforts in acquiring new customers.

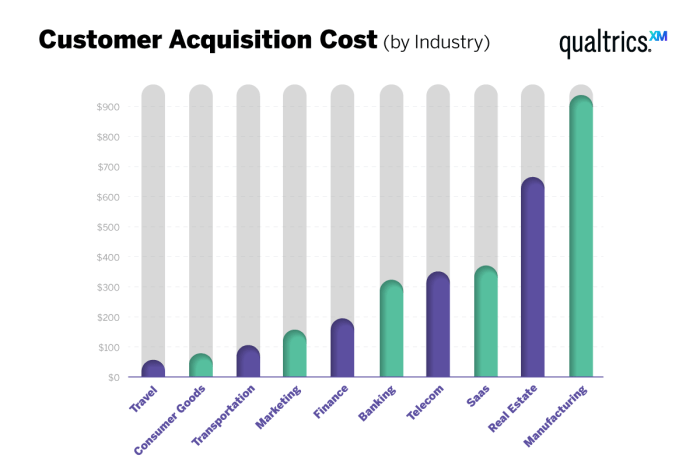

Significance of benchmarking CAC against industry standards

Benchmarking CAC against industry standards allows businesses to gauge their performance relative to competitors. If a company’s CAC is significantly higher than industry averages, it may indicate inefficiencies in their customer acquisition process. Conversely, a lower CAC could suggest a competitive advantage in acquiring customers more cost-effectively.

Impact of CAC on overall business profitability

Understanding the impact of CAC on overall business profitability is essential. If the CAC is too high, it can eat into profit margins and hinder sustainable growth. By optimizing CAC and finding cost-effective ways to acquire customers, businesses can improve profitability and long-term success.

Interpreting CAC trends over time

Analyzing CAC trends over time provides valuable insights into the effectiveness of marketing campaigns and sales strategies. If CAC is increasing, it could indicate diminishing returns on customer acquisition efforts. On the other hand, a decreasing CAC may suggest improvements in targeting and conversion rates. Monitoring CAC trends allows businesses to make data-driven decisions and adapt their strategies accordingly.