Kicking off with The Benefits of Long-Term Crypto Investments, this topic delves into the world of cryptocurrencies, exploring the advantages of holding onto these digital assets for the long haul. Get ready to discover the potential growth opportunities, diversification strategies, and tax implications that come with long-term crypto investments.

Benefits of Long-Term Crypto Investments

Long-term crypto investments involve holding onto digital assets for an extended period, typically years, with the expectation of significant growth in value over time.

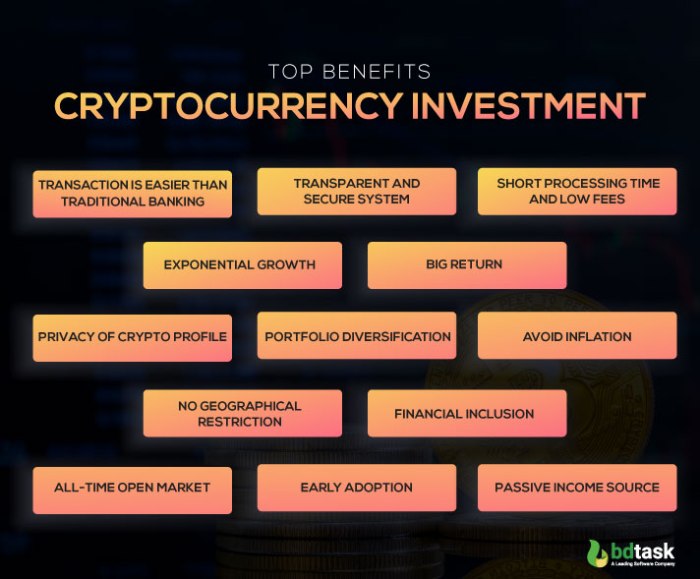

Advantages of Long-Term Crypto Investments

- Steady Growth: Long-term crypto investments have the potential for substantial growth as the value of digital assets tends to increase over time, especially for popular cryptocurrencies like Bitcoin and Ethereum.

- Risk Mitigation: Holding onto crypto assets for the long term can help mitigate the impact of short-term market volatility and price fluctuations, providing a more stable investment approach.

- Compound Interest: By reinvesting profits and gains back into the initial investment, long-term crypto investors can benefit from the power of compound interest, leading to exponential growth over time.

- Strategic Planning: Long-term investments allow investors to strategically plan for their financial future, set clear goals, and make informed decisions based on a long-term perspective rather than short-term gains.

Comparison with Short-Term Strategies

- Short-term crypto investments involve buying and selling digital assets quickly to take advantage of price fluctuations, often resulting in higher risks and volatility compared to long-term strategies.

- Long-term investments are more suitable for investors looking for steady growth and value appreciation over time, while short-term strategies are better suited for those seeking quick profits but with higher risks involved.

- Short-term investors may face challenges such as emotional trading, market timing issues, and the need for constant monitoring, whereas long-term investors can benefit from a more hands-off approach and less stress.

- Ultimately, the choice between long-term and short-term crypto investments depends on individual financial goals, risk tolerance, and investment preferences.

Potential Growth Opportunities

Cryptocurrencies have the potential for significant growth over the long term, making them attractive investment options for those willing to hold onto their assets for an extended period. The volatile nature of the crypto market means that prices can fluctuate rapidly, presenting both risks and opportunities for investors.

Bitcoin: A Pioneer in Growth

Bitcoin, the first and most well-known cryptocurrency, has shown remarkable growth since its inception in 2009. Despite experiencing extreme price fluctuations, Bitcoin has consistently increased in value over the years, making it a popular choice for long-term investors.

- Bitcoin’s price surged from just a few cents to over $60,000 in 2021, demonstrating its potential for exponential growth.

- Investors who held onto Bitcoin for several years have seen substantial returns on their initial investment, highlighting the benefits of long-term holding.

Ethereum: The Rise of Smart Contracts

Ethereum is another cryptocurrency that has shown significant growth potential due to its innovative smart contract technology. As the platform for a wide range of decentralized applications (dApps), Ethereum’s value has steadily increased over time.

- Ethereum’s price has risen from a few dollars to over $4,000 in 2021, attracting investors looking for long-term growth opportunities.

- The adoption of Ethereum’s blockchain technology by various industries further enhances its potential for growth in the future.

Risks of Long-Term Crypto Investments

While long-term crypto investments can offer substantial growth opportunities, they also come with inherent risks that investors should be aware of.

- The volatile nature of the crypto market can lead to significant price fluctuations, resulting in potential losses for investors who are not prepared for market swings.

- Regulatory changes, security breaches, and technological advancements can also impact the value of cryptocurrencies, posing risks to long-term investment strategies.

Diversification and Risk Management

Cryptocurrency investments offer a unique opportunity to diversify your investment portfolio beyond traditional assets like stocks and bonds. By including crypto assets, investors can potentially reduce overall risk and enhance returns over the long term.

Diversification Benefits

- Diversification in crypto investments involves spreading your funds across different digital assets to minimize the impact of a single asset’s price volatility on your overall portfolio.

- By including cryptocurrencies in your investment mix, you can access new markets and industries that may not be available through traditional investments, thus reducing correlation with other asset classes.

- Historically, cryptocurrencies have shown low correlation with traditional asset classes, making them a valuable addition for risk management.

Risk Management Strategies

- One strategy for managing risks in long-term crypto investments is to set clear investment goals and time horizons, helping you stay focused on your long-term objectives despite short-term market fluctuations.

- Diversifying across different cryptocurrencies and allocating a portion of your portfolio to stablecoins or other less volatile assets can help reduce risk exposure.

- Regularly reviewing and rebalancing your crypto portfolio based on market conditions and your risk tolerance can help mitigate risks and optimize returns over time.

Risk Monitoring and Mitigation, The Benefits of Long-Term Crypto Investments

- Use reliable cryptocurrency tracking platforms and tools to monitor the performance of your investments, set alerts for price movements, and stay informed about market trends.

- Implement stop-loss orders or other risk management tools provided by cryptocurrency exchanges to protect your investments from sudden price drops and limit potential losses.

- Stay informed about regulatory developments and security threats in the crypto space, and consider using hardware wallets or secure storage solutions to safeguard your assets from hacks or theft.

Tax Implications and Regulations: The Benefits Of Long-Term Crypto Investments

When it comes to long-term crypto investments, understanding the tax implications and regulations is crucial for investors to navigate the crypto market successfully.

Tax Implications of Holding Cryptocurrencies

- Capital gains tax: Profits made from selling cryptocurrencies are subject to capital gains tax. The tax rate can vary depending on how long the asset was held.

- Income tax: Mining, staking, or earning cryptocurrencies as income is taxable and should be reported on tax returns.

- Reporting requirements: Investors need to keep detailed records of transactions for tax purposes and report any gains or losses accurately.

Regulations Impacting Long-Term Crypto Investments

- Regulatory uncertainty: Changes in regulations can impact the value and legality of certain cryptocurrencies, affecting long-term investments.

- Compliance requirements: Investors must adhere to anti-money laundering (AML) and know your customer (KYC) regulations when dealing with cryptocurrencies.

- Tax laws: Different countries have varying tax laws related to cryptocurrencies, making it essential for investors to stay informed and compliant.

Navigating Tax Laws and Regulations

- Consulting a tax professional: Seeking advice from a tax professional can help investors understand their tax obligations and optimize their investment strategies.

- Keeping accurate records: Maintaining detailed records of transactions, purchases, and sales can streamline tax reporting and ensure compliance with regulations.

- Staying informed: Keeping up to date with changing tax laws and regulations can help investors make informed decisions and avoid potential penalties.