The Evolution of Digital Assets and Crypto takes us on a wild ride through the world of finance, exploring the rise of digital assets, the evolution of cryptocurrencies, tokenization of assets, and the regulatory landscape. Get ready to uncover the secrets of this digital revolution!

From the early days of Bitcoin to the tokenization of real estate, this topic will open your eyes to the possibilities and challenges of the digital asset world.

The Rise of Digital Assets

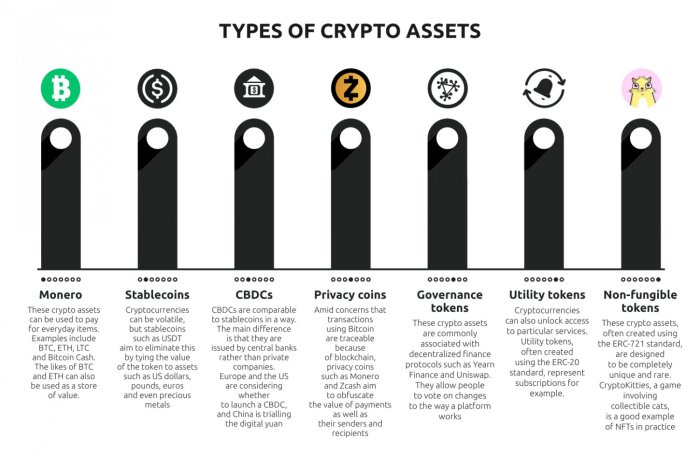

Digital assets are virtual or electronic assets that hold value and can be owned or traded. They have become increasingly popular in the financial world due to their decentralized nature and the opportunities they offer for investment and innovation. Examples of digital assets include cryptocurrencies like Bitcoin, Ethereum, and Litecoin, as well as digital tokens representing ownership of assets, like real estate or artwork.

Popular Digital Assets and Market Trends

- Bitcoin: Bitcoin is the first and most well-known cryptocurrency, often referred to as digital gold. Its market value has experienced significant fluctuations over the years, with periods of rapid growth and steep declines.

- Ethereum: Ethereum is a decentralized platform that enables smart contracts and decentralized applications (DApps) to be built on its blockchain. Its native cryptocurrency, Ether, has also seen substantial market growth.

- Non-Fungible Tokens (NFTs): NFTs have gained popularity in recent years, allowing digital assets like art, music, and collectibles to be tokenized and traded. The NFT market has seen a surge in interest and value, with unique digital items selling for millions of dollars.

Evolution of Digital Assets to Cryptocurrencies

Digital assets have evolved over time, leading to the creation of cryptocurrencies like Bitcoin and Ethereum. These digital currencies are built on blockchain technology, offering secure and transparent transactions without the need for intermediaries. Cryptocurrencies have gained widespread adoption and are now considered a viable alternative to traditional fiat currencies in some cases.

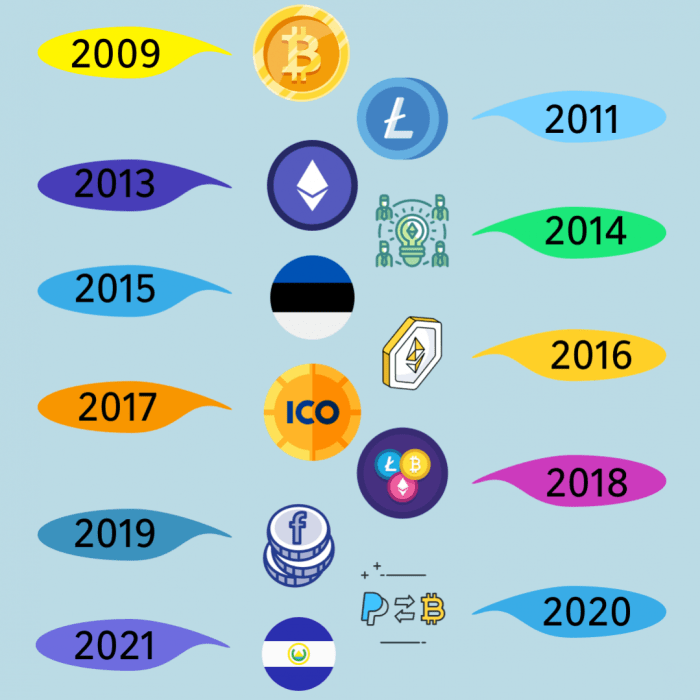

Evolution of Cryptocurrencies

Cryptocurrencies have come a long way since the introduction of Bitcoin in 2009 by the mysterious figure known as Satoshi Nakamoto. Bitcoin was the first decentralized digital currency, utilizing blockchain technology to enable peer-to-peer transactions without the need for intermediaries like banks. This groundbreaking innovation paved the way for the development of numerous other cryptocurrencies, collectively known as altcoins.

Different Cryptocurrency Technologies

- Bitcoin (BTC): As the pioneer cryptocurrency, Bitcoin remains the most widely recognized and valuable digital asset in the market. It operates on a proof-of-work consensus mechanism, requiring miners to solve complex mathematical puzzles to validate transactions.

- Ethereum (ETH): Introduced in 2015, Ethereum revolutionized the cryptocurrency space by enabling smart contracts and decentralized applications (DApps) to be built on its blockchain. Ethereum’s native currency, Ether, is used to fuel transactions on the network.

- Ripple (XRP): Ripple focuses on enabling fast and low-cost cross-border payments through its digital asset XRP. Unlike Bitcoin and Ethereum, Ripple operates on a consensus protocol rather than a traditional blockchain, making it more efficient for financial institutions.

- Litecoin (LTC): Created in 2011 by Charlie Lee, Litecoin is often referred to as the silver to Bitcoin’s gold. It offers faster transaction times and lower fees compared to Bitcoin, making it a popular choice for everyday transactions.

Impact of Blockchain Technology, The Evolution of Digital Assets and Crypto

Blockchain technology has revolutionized the way digital assets are transacted by providing a transparent, secure, and immutable ledger for recording transactions. This decentralized approach eliminates the need for intermediaries, reducing costs and increasing efficiency in financial transactions.

Tokenization of Assets: The Evolution Of Digital Assets And Crypto

Tokenization refers to the process of converting rights to an asset into a digital token on a blockchain. This innovative approach allows traditional assets such as real estate, art, or commodities to be represented digitally, enabling fractional ownership and increased liquidity in the market.

Examples of Tokenized Assets

- Real Estate: Fractional ownership of properties through tokens, making it easier for investors to participate in the real estate market.

- Art: Tokenizing artwork allows art lovers to own a share of valuable pieces, opening up investment opportunities in the art industry.

- Commodities: Tokenization of commodities like gold or oil enables investors to trade these assets in a more efficient and transparent manner.

Benefits and Challenges of Tokenizing Assets

- Benefits:

- Increased Liquidity: Tokenizing assets can unlock liquidity by allowing for easier buying and selling of fractions of assets.

- Fractional Ownership: Investors can own a portion of high-value assets that were previously out of reach.

- Transparency: Blockchain technology provides a transparent and secure way to track ownership and transactions.

- Challenges:

- Regulatory Uncertainty: The legal framework surrounding tokenized assets is still evolving, creating uncertainty for market participants.

- Security Risks: Digital assets are vulnerable to hacking and cyberattacks, posing a threat to the security of tokenized assets.

- Lack of Standardization: There is a lack of standardization in tokenization practices, leading to potential interoperability issues between different platforms.

Regulatory Landscape

The regulatory landscape surrounding digital assets and cryptocurrencies is a complex and evolving one. Governments and regulatory bodies around the world are grappling with how to approach this new form of finance, which operates outside of traditional banking systems. The lack of a unified approach has led to a patchwork of regulations that can vary significantly from country to country.

Global Regulatory Challenges

- Regulatory Uncertainty: One of the biggest challenges facing digital assets is the lack of regulatory clarity. Many countries are still in the process of determining how to regulate cryptocurrencies and tokenized assets.

- Money Laundering and Terrorist Financing: Regulators are concerned about the potential for digital assets to be used for illicit purposes such as money laundering and terrorist financing. Implementing effective AML (Anti-Money Laundering) and KYC (Know Your Customer) measures is crucial.

- Investor Protection: There is a need to protect retail investors from scams and fraudulent activities in the digital asset space. Regulatory oversight can help ensure that investors are not being misled or taken advantage of.

Comparative Regulatory Approaches

- United States: The U.S. has taken a relatively cautious approach to regulating digital assets, with different regulatory bodies like the SEC, CFTC, and FinCEN each overseeing different aspects of the industry.

- European Union: The EU has proposed a comprehensive regulatory framework for cryptocurrencies and digital assets, aiming to provide legal certainty and foster innovation in the sector.

- China: China has banned cryptocurrency trading and initial coin offerings (ICOs) but has shown interest in developing its own central bank digital currency (CBDC).

Importance of Regulatory Clarity

- Market Confidence: Clear and consistent regulations can help build trust and confidence in the digital asset market, attracting more institutional investors and mainstream adoption.

- Innovation and Growth: Regulatory clarity can encourage innovation and investment in the digital asset space, driving growth and development of new technologies.

- Legal Compliance: Businesses operating in the digital asset sector need clear guidelines to ensure they are compliant with regulatory requirements and avoid legal risks.