The Importance of Diversification in Crypto Investment sets the stage for smart investing in the fast-paced world of cryptocurrencies. Let’s dive into the key strategies and techniques to navigate this volatile market and secure your financial future.

Exploring different diversification strategies, risk management techniques, and the impact of market trends will equip you with the knowledge needed to thrive in the crypto space.

Importance of Diversification in Crypto Investment: The Importance Of Diversification In Crypto Investment

Diversification is crucial in the volatile crypto market to spread out risks and protect your investment from extreme fluctuations. By investing in a variety of cryptocurrencies, you can reduce the impact of a single asset’s poor performance on your overall portfolio.

Examples of Diversification in Crypto Investments

- Diversifying across different types of cryptocurrencies, such as large-cap, mid-cap, and small-cap coins, can help balance out the risks associated with each category.

- Investing in various sectors within the crypto industry, like decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain platforms, can provide exposure to different market trends and opportunities.

- Allocating a portion of your portfolio to stablecoins or fiat currencies can act as a hedge against market downturns, providing stability during times of high volatility.

Increased Returns through Diversification

Diversification not only helps manage risk but can also potentially increase overall returns in a crypto portfolio. By spreading investments across multiple assets, you have the opportunity to capture gains from different market movements and capitalize on the growth of various cryptocurrencies.

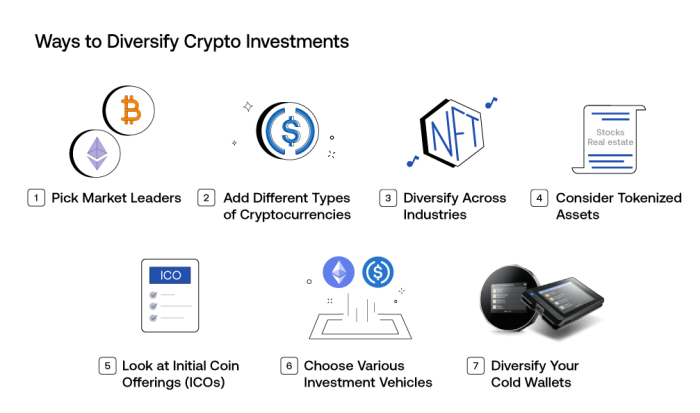

Types of Diversification Strategies

When it comes to diversifying your crypto investments, there are several strategies you can employ to minimize risk and maximize returns. Each strategy has its own benefits and drawbacks, so it’s essential to understand them before making investment decisions.

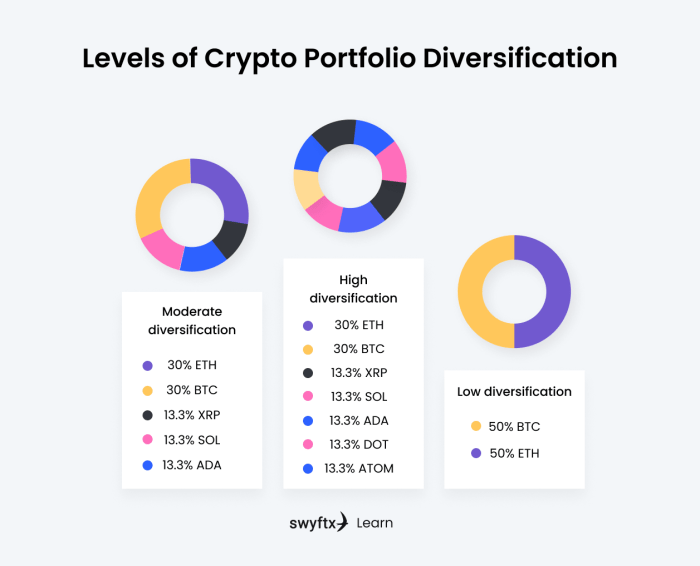

Asset Allocation

Asset allocation involves spreading your investment across different types of cryptocurrencies or digital assets. This strategy aims to reduce risk by not putting all your eggs in one basket. By diversifying across various assets, you can potentially offset losses in one asset with gains in another. However, the drawback is that if one sector of the market performs poorly, it can drag down your overall portfolio’s performance.

Sector Diversification

Sector diversification involves investing in cryptocurrencies from different sectors or industries. For example, you may choose to invest in both decentralized finance (DeFi) tokens and non-fungible tokens (NFTs). This strategy helps reduce the impact of sector-specific risks on your portfolio. The benefit is that if one sector experiences a downturn, other sectors may still perform well. On the downside, if the entire crypto market faces a downturn, sector diversification may not offer full protection.

Geographic Diversification

Geographic diversification involves investing in cryptocurrencies from different regions around the world. This strategy aims to reduce the impact of regulatory changes or economic conditions in a single country on your portfolio. By spreading your investments globally, you can potentially benefit from diverse market conditions. However, the drawback is that you may face challenges related to currency exchange rates and geopolitical risks.

Risk Management in Diversified Crypto Portfolios

Investing in the crypto market can be highly volatile and risky. Therefore, having a solid risk management strategy is crucial when building a diversified crypto portfolio. Risk management involves assessing potential risks and taking preventive measures to minimize losses.

Role of Risk Management

Risk management plays a vital role in protecting your investments in the crypto market. By diversifying your portfolio across different cryptocurrencies, you can spread out risks and reduce the impact of market fluctuations on your overall investment. This helps in minimizing losses during market downturns and ensures a more balanced and stable portfolio.

Risk Management Techniques for Crypto Investments

- Setting Stop-Loss Orders: Setting stop-loss orders on your trades can help limit your losses by automatically selling a cryptocurrency when its price reaches a certain point.

- Portfolio Rebalancing: Regularly rebalancing your portfolio by adjusting the allocation of assets can help maintain the desired risk level and optimize returns.

- Using Dollar-Cost Averaging: Investing a fixed amount at regular intervals can help reduce the impact of volatility on your investments over time.

- Stress Testing: Conducting stress tests on your portfolio to simulate different market scenarios can help identify potential weaknesses and adjust your risk management strategy accordingly.

Benefits of Diversification in Risk Management

Diversification is a key strategy in risk management for crypto investments. By spreading your investments across different cryptocurrencies with varying risk profiles, you can reduce the overall risk exposure of your portfolio. This helps in safeguarding your investments against unexpected market movements and ensures a more stable and resilient portfolio.

Impact of Market Trends on Diversification

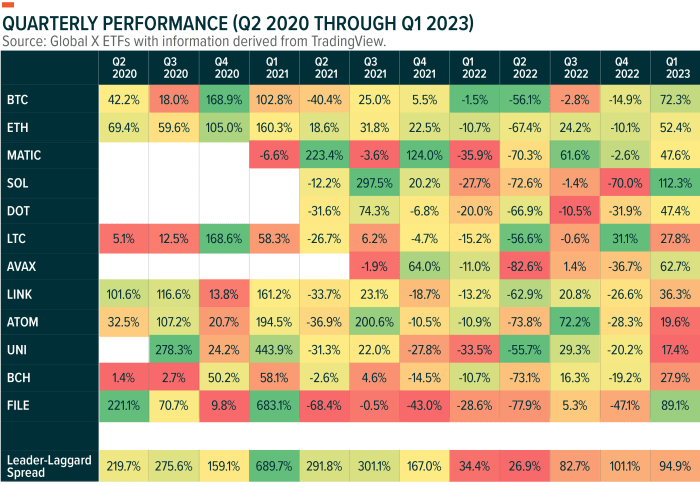

Market trends play a crucial role in determining the success of diversification in crypto investments. Understanding how these trends can affect your portfolio is essential for making informed decisions and optimizing your investment strategy.

Adapting Diversification Strategies to Market Trends

- Market trends can shift rapidly in the crypto space, impacting the value of different assets in your portfolio. By monitoring these trends closely, investors can adjust their diversification strategies accordingly to mitigate risks and capitalize on opportunities.

- For example, during a bull market, certain cryptocurrencies may experience significant growth while others may lag behind. In this scenario, diversifying your portfolio across various asset classes can help balance out potential losses and maximize returns.

- Conversely, in a bear market, diversification can help protect your investments from substantial losses by spreading risk across different assets that may respond differently to market conditions.

Staying vigilant and adaptable to market trends is key to maintaining a well-diversified crypto portfolio.

Optimizing Portfolio Performance Through Market Awareness, The Importance of Diversification in Crypto Investment

- By staying informed about market changes, investors can make timely adjustments to their diversification strategies. This includes reallocating assets, adding new positions, or reducing exposure to underperforming assets based on current market conditions.

- Market trends can provide valuable insights into potential shifts in investor sentiment, regulatory developments, technological advancements, and other factors that may impact the crypto market. Adapting your diversification approach in response to these trends can help you stay ahead of the curve and optimize your portfolio performance.