As The Rise of Bitcoin and Its Impact on the Crypto Market takes center stage, this opening passage beckons readers with american high school hip style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Bitcoin, the trailblazer of the cryptocurrency world, has revolutionized how we perceive and interact with money. Its meteoric rise has not only captivated investors but also reshaped the financial landscape as we know it. Let’s dive into the fascinating journey of Bitcoin and explore its profound impact on the crypto market.

The History of Bitcoin

Bitcoin, the first decentralized cryptocurrency, was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Its creation was a response to the financial crisis of 2008, aiming to provide an alternative to traditional fiat currencies controlled by central governments and financial institutions.

Origins and Creation of Bitcoin

Bitcoin was introduced through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” published by Satoshi Nakamoto in October 2008. The actual implementation of the cryptocurrency took place in January 2009 with the mining of the first block, known as the Genesis Block. This marked the beginning of the Bitcoin network and the issuance of the first bitcoins.

Key Events Influencing the Rise of Bitcoin

– In 2010, the first documented commercial transaction using Bitcoin took place when a programmer paid 10,000 bitcoins for two pizzas.

– The creation of cryptocurrency exchanges like Mt. Gox in 2010 and the introduction of other altcoins paved the way for the growth of the crypto market.

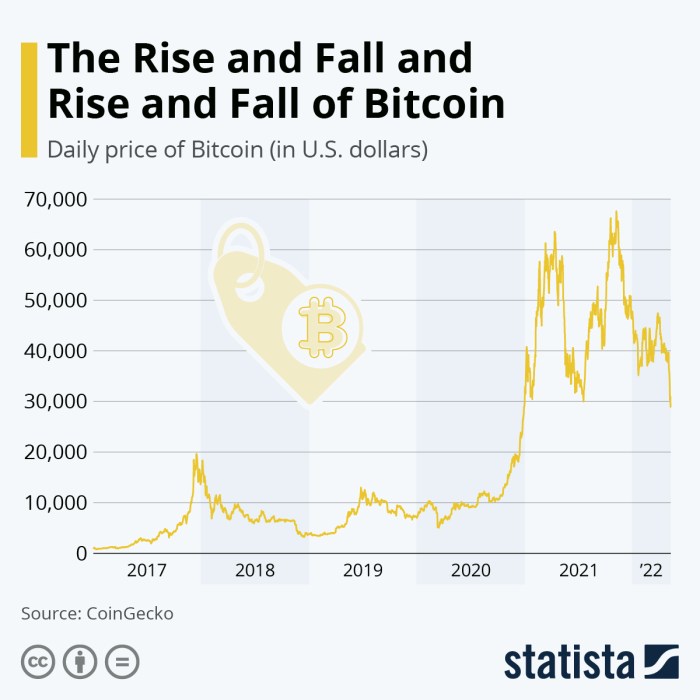

– The 2017 bull run saw Bitcoin’s price reaching an all-time high, bringing mainstream attention to the digital asset.

Popularity of Bitcoin Over the Years

Bitcoin gained popularity as more individuals and institutions recognized its potential as a store of value and investment asset. Factors such as scarcity, decentralization, and security contributed to its appeal. Additionally, the growing acceptance of Bitcoin as a form of payment by businesses and the integration of blockchain technology into various industries further propelled its adoption.

Impact on the Financial Market

Bitcoin has caused a significant disruption in traditional financial systems, challenging the way we perceive and interact with currency and investments. Its decentralized nature and limited supply have shifted the power dynamics in the financial world, leading to a reevaluation of traditional banking systems and centralized authorities.

Volatility Comparison, The Rise of Bitcoin and Its Impact on the Crypto Market

- Bitcoin’s price volatility is much higher compared to traditional assets like stocks and gold. The value of Bitcoin can fluctuate dramatically within a short period, leading to both significant gains and losses for investors.

- Stocks and gold are generally considered more stable investments, with prices that tend to fluctuate less erratically over time. This stability provides a sense of security for investors looking to preserve their wealth.

- The high volatility of Bitcoin has attracted both risk-takers seeking substantial returns and critics who warn of the potential dangers associated with such price swings.

Reactions of Financial Institutions

- Financial institutions have shown mixed reactions to the rise of Bitcoin. Some have embraced the technology behind Bitcoin, such as blockchain, for its potential to streamline transactions and reduce costs.

- On the other hand, many traditional banks and financial experts remain skeptical of Bitcoin’s long-term viability and view it as a speculative asset with inherent risks.

- Regulatory bodies have also struggled to keep up with the evolving crypto market, leading to debates on how to effectively monitor and regulate digital currencies like Bitcoin.

Technology Behind Bitcoin: The Rise Of Bitcoin And Its Impact On The Crypto Market

Bitcoin operates on a technology called blockchain, which is a decentralized and distributed ledger that records all transactions across a network of computers. This technology ensures transparency, security, and immutability of the transaction data.

Bitcoin Mining

Bitcoin mining is the process through which new Bitcoins are created and transactions are verified on the blockchain. Miners use powerful computers to solve complex mathematical problems, and in return, they are rewarded with new Bitcoins. However, this process requires a significant amount of computational power and energy consumption, leading to concerns about its environmental impact.

- Bitcoin mining consumes a large amount of electricity, with some estimates suggesting that it consumes as much energy as entire countries.

- The energy-intensive nature of Bitcoin mining has raised concerns about its sustainability and environmental impact, especially as the network continues to grow.

- Efforts are being made to make Bitcoin mining more energy-efficient through the use of renewable energy sources and technological advancements.

Scalability Issues

One of the major challenges that Bitcoin faces is scalability, which refers to the ability of the network to handle a large number of transactions quickly and efficiently. As more users join the network and the number of transactions increases, Bitcoin’s scalability becomes a pressing issue.

- Bitcoin’s current block size limit of 1MB restricts the number of transactions that can be processed in a block, leading to network congestion and higher transaction fees.

- Various proposals have been put forward to address Bitcoin’s scalability issues, including increasing the block size, implementing off-chain solutions like the Lightning Network, and optimizing the transaction processing algorithms.

- Finding a balance between scalability, security, and decentralization is crucial for the long-term success of Bitcoin as a global payment system.

Market Trends and Investor Sentiment

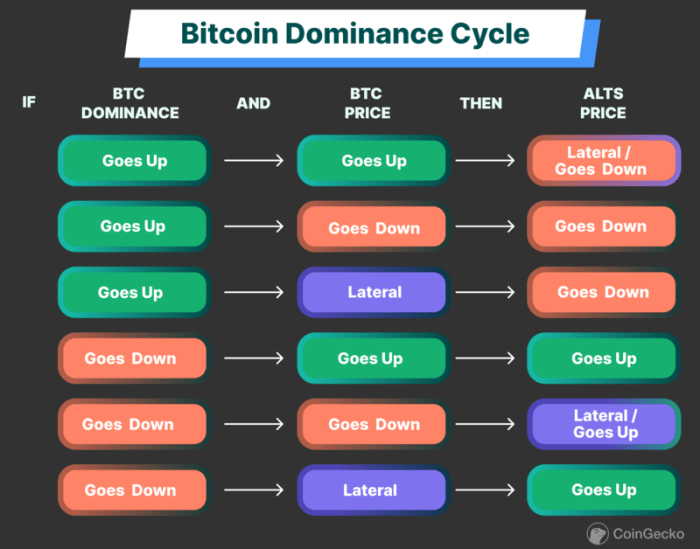

Cryptocurrency market trends are heavily influenced by the ever-evolving landscape of Bitcoin. As the pioneer cryptocurrency, Bitcoin’s price movements often set the tone for the entire market. Investor sentiment plays a crucial role in dictating these trends, as the collective optimism or pessimism of market participants can lead to significant price fluctuations.

Current Trends in the Crypto Market

- Bitcoin dominance: Despite the emergence of numerous altcoins, Bitcoin continues to maintain its dominance in the market cap.

- DeFi boom: The rise of decentralized finance (DeFi) platforms has been a major trend in the crypto space, offering innovative financial services.

- NFT craze: Non-fungible tokens (NFTs) have gained immense popularity, creating a new market for digital art and collectibles.

Role of Investor Sentiment in Bitcoin Price

- Market psychology: Investor sentiment, whether driven by fear, greed, or optimism, can lead to volatile price swings in Bitcoin.

- FOMO and FUD: Fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD) are common sentiments that can drive buying or selling pressure.

- Social media influence: The sentiment expressed on social media platforms can also impact investor behavior and, consequently, Bitcoin’s price.

Institutional Investors in the Bitcoin Market

- Increasing adoption: Institutional investors, such as hedge funds and corporations, are increasingly showing interest in Bitcoin as a store of value and hedge against inflation.

- Market influence: The entry of institutional players into the Bitcoin market can lead to increased liquidity and stability, but their actions can also drive significant price movements.

- Regulatory concerns: Institutional involvement in Bitcoin is often accompanied by regulatory scrutiny, which can impact investor sentiment and market trends.